f you had invested a piggy bank’s worth of quarters in Bitcoin a few years back, you could now have a penthouse, a convertible, and one of the moons orbiting Saturn. Or nothing. Its maddening highs and lows, the digital age is rapidly disrupting the world of finance, from cryptocurrencies to AI to robo-investors to the cold hard cash in our pockets (or lack thereof). Here’s how to get rich — or become confounded trying — in the new financial future.

CRYPTOCURRENCY, EXPLAINED

What is it?

Digital systems of money that are not issued by a government or controlled by banks.

This decentralized structure is the biggest selling point of cryptocurrency. Essentially, they offer a way to take full ownership of your money, store it securely, and make — relatively — anonymous payments. (Sure, yes, to make it easier to dodge taxes and buy drugs, if you must.)

Why it seems exciting

It could make you a billionaire!

Why it’s scary

The market is volatile, unregulated, and frankly, a headache to comprehend. Attempts to become a billionaire could quickly sabotage your entire savings account.

But…

It could make you a billionaire!

MEET THE CRYPTO CLASS OF 2018

Most likely to succeed:

Bitcoin

The original.

Most promising:

Ether

The main currency of the Ethereum platform, which lets developers build apps upon its blockchain technology.

Most improved:

Ripple

Faster payments, lower transaction fees.

Most mysterious:

Dash

Offers truly anonymous transactions that keep addresses off of the record.

Most frivolous:

Litecoin

Designed for speed and ease-of-use to improve smaller transactions, like buying a soda.

Most unnecessary:

Lydian

Convinced Paris Hilton to endorse it. Then word got out that its CEO had been convicted of domestic abuse.

Talk the Talk

It’s not exactly learning Latin, but it’s close.

“‘Her voice is full of money,’ he said suddenly.” — F. Scott Fitzgerald, The Great Gatsby

Coin

A unit of a cryptocurrency. Some, like Bitcoin, have finite supplies, with fewer coins released into circulation each year.

Address

A string of randomly generated characters that acts as your identity-obscuring pseudonym in a transaction.

Private Key

Another string of characters, required to access the coins linked to any given address. Easily mistaken for your grandma’s Wi-Fi password.

Miner

A computer that’s part of a network of machines working to validate ongoing cryptocurrency transactions and keep the system secure. Miners are rewarded for their work with a small amount of new coins.

Blockchain

A public database — or “digital ledger” — of all verified transactions made with a cryptocurrency. Generated as a joint effort by all miners, it logs data without granting control of that data to any one third party.

MEANWHILE, IN CASH MONEY…

If all of the buzz surrounding cryptocurrency has you ready to pronounce the banknote’s time of death, not so fast. Our favourite coffee shops are still insisting we pay with coin, and for its part, The Bank of Canada recently stressed that “cash provided by a central bank is the only truly risk-free means of payment.” It’s vying to keep its reliable, old-school money crisp by releasing a new $10 bill at the end of this year. The note will be the first in a planned series incorporating the latest in anti-counterfeiting tech (think extra-trippy holograms) and dedicated to a fresh roster of notable Canadians.

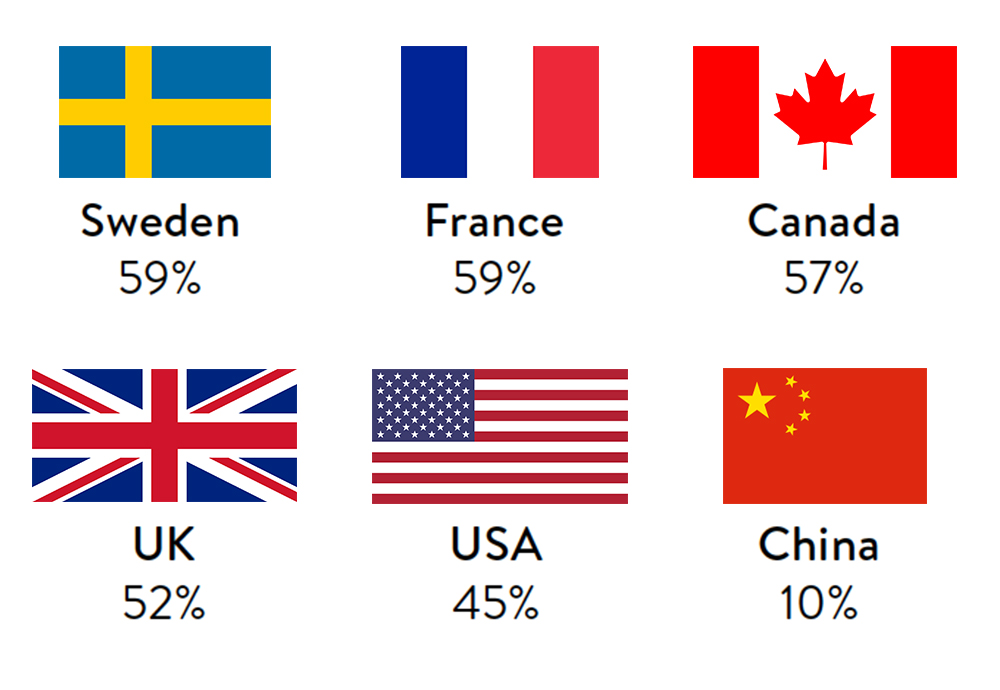

Percentage of consumer transactions made with non-cash methods:

WHAT TO INVEST IN INSTEAD

Extremely volatile markets that are still less volatile than cryptocurrency.

Art

Dollar Sign, Andy Warhol

$7.2 million at auction, 2017 (a 41% increase since 2010).

Relive the dollar’s glory days.

Real Estate

432 Park Avenue, New York City

$91.1 million for three conjoined penthouses (NYC’s average price/sq ft has increased 67% since 2010).

A vertical blockchain you can live in!

Stocks

AAPL, SSNLF

$170 USD, $2280 USD per stock (a 447% and 237% increase since 2010, respectively).

Want to make a crypto transfer? You’re going to need a mobile device.

Coins

A rare 1936 penny featuring a raised dot above the year

$400,000 at auction in 2010 (a 400,000% increase since 1936).

Somehow, still less nerdy than Bitcoin.

THE YEAR AHEAD…

Two new cryptocurrency developments set to make waves.

Initial Coin Offerings

Fledgling startups are now seeking funding for their blockchain-based endeavours by creating their own cryptocurrency, which can be bought initially as an investment and then later used for payments within their system. The ICO for Rentberry, which aims to automate the process of signing leases and paying rent with smart contracts technology, recently raised over $20 million.

The Lightning Network

A fix for Bitcoin’s high transaction fees and slow transaction times, these expediated payment channels will allow low-risk trans- actions to take place without having to be logged on the blockchain. Balances will then be periodically recorded to the main ledger as a way to finalize all of the transactions that have taken place in the prior time period. Currently in a testing phase, it’s slated to be built it into the system later this year.